Peer-to-peer lending sites have been around in the UK since 2005, yet it’s still a fairly unfamiliar concept to many.

With the rate of interest set by the Bank of England being at an all-time low, more and more people are looking at peer-to-peer lending as a viable alternative to traditional savings accounts. In many cases, you may be able to get significantly more interest on your savings than at a high street bank.

As Rhydian Lewis, CEO of leading P2P site RateSetter explains, "The last three years have seen a quiet revolution in the world of personal finance, driven by an understanding that traditional savings products are no longer competitive.

With the P2P industry passing the £1 billion mark and regulation on the horizon this growth is only set to continue."

We’ve put together this simple guide to peer-to-peer lending so you can decide whether it’s right for you before making any big decisions.

What exactly is peer-to-peer lending?

First of all we need to answer what this new type of lending actually is. In it’s simplest form, peer-to-peer lending is the process of lending money to other individuals or businesses via third party financial intermediaries.

These are often companies that operate solely online and provide the technology and support to make this happen.

What are the main peer-to-peer lending sites in the UK?

One of the largest and most well known sites is

Zopa, which was one of the first to launch back in 2005.

RateSetter was then launched in 2010 to offer an alternative to Zopa and is now one of the key players in the UK.

Funding Circle was also set up in 2010, but differs from the others as it focuses on lending money to businesses, rather than individuals.

All make their money from the difference between the interest rate that you’re offered as a lender, and the interest rate that a borrower is charged on the loan. For example, you may receive an interest rate of 5% as a lender, but the borrower may be paying an interest rate of 7%.

This is very similar to the way that traditional financial institutions such as banks operate.

What are the benefits with using peer-to-peer lending services?

For both borrowers and lenders the key benefit is the interest rate offered.

Borrowers often pay far less than they may need to either with a payday loan company or with a traditional bank loan. For businesses, this can often mean that they can also get access to loans that they wouldn’t be able to get otherwise, which in turn is great for the economy.

As a lender, you’ll also find the interest rates offered are extremely favorable, often far above what you’d receive in a traditional building society savings account or current account with your bank. This means that your money is working harder for you, generating greater returns each year and helping to ensure that your savings keep pace with inflation.

At the time of writing, if you’re prepared to keep your money in for 5 years or longer, RateSetter and Funding Circle are both offering over 5.5% interest to lenders, followed by Zopa on 5%. When you compare these rates to a traditional 5-year fixed savings account, which are generally offering around 3.25%, the disparity is clear.

Are the any risks with peer-to-peer lending?

No official financial protection if the company goes bust

All of the risks tend to fall upon lenders rather than borrowers, which is reflective of most credit agreements. Unlike banks, peer-to-peer lending companies are not covered (at the time of writing) by the

Financial Services Compensation Scheme.

This means that you won’t be covered for an amount up to £85,000 per financial institution, so if the company goes under, you’ll have to chase the borrowers to get your money back. Understandably, this is a huge drawback and is a significant risk if you’re looking to lend tends of thousands of pounds through peer-to-peer lending sites.

All of the companies mentioned within this article are members of the Peer To Peer Finance Association which does offer some help, as they are all required (as part of the membership) to have insurance to pay for third party debt collectors to help reclaim your money from borrowers if the company goes bust.

Borrowers may default on loan repayments

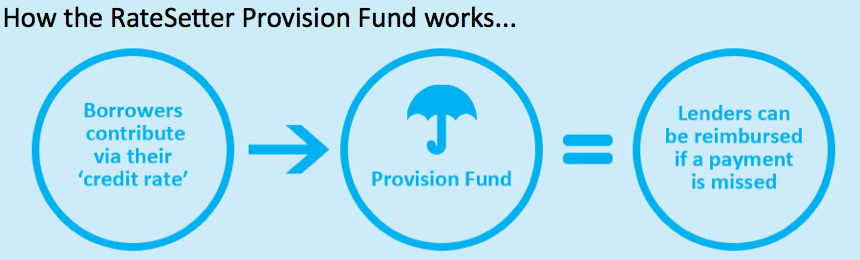

Several peer-to-peer lending sites (including RateSetter and Zopa) try to mitigate the lending risk further, by having a provisional fund for bad debt. This means that if an individual or business defaults on the loan, there should be more than enough in the fund to ensure you’re still repaid.

To top this fund up, a small amount of the interest is added on top of the amount that borrowers are charged on the loan. Rhydian Lewis (CEO of RateSetter) explained to us just how important the provisional fund is, quoting their "100% record, unique in the P2P sector, of ensuring every lender has received every penny of their money back", which clearly demonstrates how well the risk can be managed. This also helped to make RateSetter the fastest growing platform in 2013, increasing by nearly 300% compared to 2012.

Peer-to-peer sites also spread out your money as wide as possible between borrowers (known as diversification), again trying to reduce the risk if there’s a default on a repayment. For example, if you place £1,000 in your account, the full £1,000 won’t be given to one specific borrower. Instead, it’s broken up into tiny amounts, so 1,000 different borrowers may each receive £1 of it.

This is then replicated across all lenders on the peer-to-peer site, so that the borrower gets the loan they need in full, but from multiple people.

This is all done behind the scenes, so as a borrower you wouldn’t receive 1,000 separate payments into your account. Funding Circle takes a different approach, allowing you to view each business loan proposal before deciding whether or not you’re happy to lend to them. This gives you full control, but it does mean your money isn’t spread out as wide and is certainly more time-intensive.

You may be charged tax on the interest rate BEFORE bad debt

The interest you receive is still taxed by the lovely people at HMRC in the same way as standard current and savings accounts. The importance of this is that with any companies that offer an interest rate that isn’t inclusive of bad debts, you’ll have to pay tax on the interest rate offered, rather than what you actually received.

So, for example, if the interest rate offered is 5%, but you actually only received the equivalent of 3% after some very bad debt, you will still be taxed as if you got the initial 5%.

I’m interested – what should I do now?

Don’t rush in! Now you’ve got a greater understanding of how peer-to-peer lending works, it’s time to do some research on your chosen provider.

1) Does the company comply with the correct UK regulations?

Although peer-to-peer lending isn’t regulated in the same way as banks, all consumer credit in the UK is licensed by the Office of Fair Trading. It’s essential that you check that the Consumer Credit License number is displayed on the website, if it isn’t you should be asking why.

Also check if the company is a member of the industry body (P2P Finance Association) or the UK’s fraud watchdog CIFAS. Without being a member of the CIFAS, it’s impossible to check if a new borrower has been reported previously as potentially fraudulent.

From April 2014, the industry will be regulated by the Financial Conduct Authority. Although this won’t offer protection on your money, it’s likely to bring in set standards and help to protect you from illegitimate companies.

2) Who will you be lending to?

Will your money be used for loans for individuals or businesses? Although the returns may be higher if you lend to a business, evidence shows that it carries more risk from defaults on loan repayments.

3) What credit check processes are in place?

It goes without saying that there’s a much greater risk of borrowers not repaying the loan if they have a poor credit history. All peer-to-peer lending companies should be able to give you clear, concise information on what systems are in place, together with their track record on loan repayment defaults. If default rates are higher than 2%, alarm bells should start to ring.

4) How does the peer-to-peer lending company compensate for bad debt?

Check out how the provider manages the risk to you as a lender. Do they spread your investment across multiple borrowers? Is there a provisional fund for bad debt and if so, how big is the fund and what’s the ratio compared to outstanding loans?

5) What is the expected return on your investment?

As a lender you’ll have to pay fees based on your transactions, which will affect the overall rate of return from a headline percentage interest offered. Make sure you know exactly how much these fees are and how defaults on loans are accounted for. You will then get a greater understanding of what the actual return may be after all other factors are included.

Our final tip

If, after doing your homework you’re happy and would like to try peer-to-peer lending, take baby steps and invest a small amount initially that you feel comfortable with.

Most sites will offer you a set interest rate based on the length of time your money is tied up for, which in some instances can be up to 5 years. Try a shorter time initially and after you’ve gained some experience, re-assess the return against other options and then look to invest for a longer period of time if you can afford to do so.