With huge amounts of different money management tools available, it’s often hard to know where to begin. We’ve reviewed the top tools across the web and have picked our top 5 below, all of which are completely free to use.

Money Dashboard

MoneyDashboard.com is one of the easiest tools to use, offering a concise overview of all of your financial accounts from a simple dashboard. You can manage your money more effectively by setting up different categories to see where most of your money is spent, as well as view all upcoming payments.

The intelligent software behind the tool then starts to learn what your spending patterns are, enabling you to set up savings goals so that you don’t end up spending more than you earn.

One of our favourite features is the ‘Clear Cash’ feature which makes it really easy to see what you can spend before the next payday, as well as predicting what you’re likely to spend in the upcoming months – perfect for picking up any big wholes in your finances before you reach an unmanageable situation.

Budget Brain from Money Saving Expert

MoneySavingExpert.com has produced it’s very own

budget planner tool called Budget Brain. If you’re new to budgeting then it should be your first port of call, helping you to budget for the entire year.

Be prepared for it to take some time before you start and make sure you’ve got everything ready, including bank statements, household bills, receipts and pay slips.

You’ll then be guided through the tool, with a wide selection of different boxes to input all of your information into. Based on this you’ll see how much you earn, are putting away for your pension and most importantly, whether you’re overspending based on your current income.

Once you’ve finished you’ll get a nice simple breakdown and the budget prepared can be saved and then edited if your circumstances change.

It’s incredibly comprehensive and even if you have budgeted before, the Budget Brain tool is likely to find things you may have overlooked so that you have a truly accurate snapshot of your current financial position. Nice work MSE!

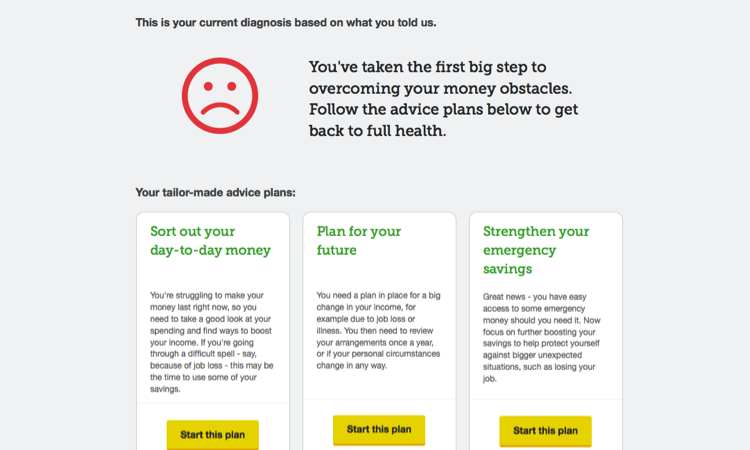

Money Health Check from the Money Advice Service

The Money Advice Service is a great resource for managing your finances effectively and as well as providing lots of tips and advice, it also has a suite of money manager tools which are all free to use.

The Budget Planner is very similar to the Money Saving Expert tool so is well worth investigating, however our favourite is the free

Money Health Check tool.

Rather than providing a full budget for the year, the Money Health Check helps you to check on your current financial position and to take drastic action if needed to get things back on track.

The tool works by asking a series of questions (with each one dependent on the previous answer) and then providing you with a ‘diagnosis’ of your position.

It doesn’t just stop here as you’re then provided with personalised plans to make sure you can take positive steps forward, whether it’s preparing for your future or getting out of the debt you may currently be in.

It’s an invaluable resource if you’re looking for a clear action plan rather than just graphs that show how well you’re managing your money. Just make sure you try to answer the questions as honestly as possible if you want to get the most out of the tool and relevant plans to follow.

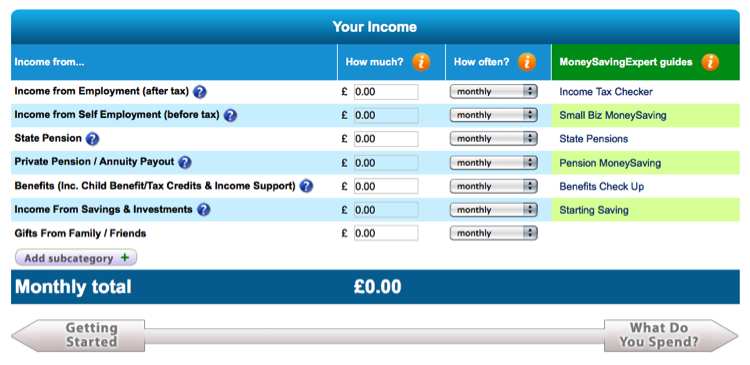

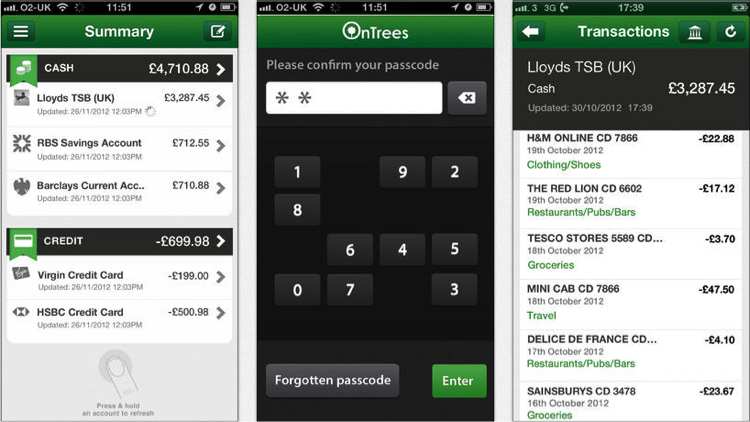

OnTrees

OnTrees.com is a free tool and smartphone application from the same company that runs the financial site ThisIsMoney.co.uk. It works by combining all of your bank accounts in one so that you can see spending patterns across various categories based on every transaction made, in a similar way to the MoneyDashboard.com tool.

It does have a few nifty features though which help it to stand out, the most noticeable being the app so that you can manage your money on the go.

The tool also allows you to set up text alerts if it looks like you’re going to go over budget, helping to you live within your means and not be met with a nasty overdraft charge at the end of the month.

One thing you can’t do is move money between accounts within the tool due to security reasons, which is a blessing really in case you get your phone stolen.

It’s also worth noting that you’ll need to spend a bit of time to start off categorizing your spending, but after this the OnTrees money manager tool will then the hard work for you.

Money Hub from Your Wealth

The

Money Hub money manager tool is unlike most of the other money management tools available in that it has much more of a focus on long term financial planning.

After registering for a free account you can add information about your current investments, pensions, ISAs and property investments, as well as your expenditure.

You’ll then be able to get projections for your future wealth, together with your current net worth so that goals can be set up to reach your objectives.

It’s a beautifully designed tool and if you’ve got significant investments you’re likely to find it extremely useful. For anyone without a nest egg, it’s a great money management tool to use when you’re looking to plan ahead for the next 20 years and have no idea where to start.